JuryEdge

Legal AI Platform for Trial Preparation

$2.25M Seed Round at $13M Pre-Money Valuation

JuryEdge combines 60+ years of combined trial experience with cutting-edge AI to automate legal case analysis and trial preparation. Our platform leverages Randy Hood/Chad McGowan's proven track record of over $2B+ in verdicts and settlements to create an intelligent system that scales expert-level legal analysis.

We are raising $2.25M to accelerate platform development, expand professional services, and produce an exit opportunity with ROI of 10-15x in 4-5 years.

Litigation Cannot Scale

THE PROBLEM: LITIGATION CANNOT SCALE. Litigation is a massive market, but its core analytical work—case evaluation, causation analysis, expert reasoning—remains fully manual. More than 400,000 firms rebuild the same workflows in isolation, producing nationwide duplication of effort. Fragmentation traps the industry in a labor-bound model where margins depend entirely on human capacity. Rising costs are driven by duplicated reasoning, not complexity. No legacy system automates the expert-level thinking that defines litigation outcomes.

Source: Thomson Reuters 2023; Georgetown Law 2023; ABA 2023.

Pressure Meets Capability

WHY NOW: PRESSURE + CAPABILITY. Attorney and expert labor costs have surged for more than a decade while the supply of experienced litigators continues to shrink. Clients demand faster assessments, clearer risk modeling, and predictable strategies that manual processes cannot deliver. Economic pressure is forcing firms to seek non-linear efficiency. Only recent AI breakthroughs allow judgment-level reasoning to be automated at scale. The industry is hitting a breaking point—and technology finally exists to solve it.

Source: NALP 2013–2023; Thomson Reuters 2023; IBISWorld 2024.

TAM Built on Duplication

THE OPPORTUNITY: A TAM BUILT ON DUPLICATION. Litigation spend exceeds $50B annually, but the true market opportunity is the billions lost to duplicated analytical work. Every firm recreates the same liability theories, medical chronologies, expert assessments, and strategic models without shared intelligence. These tasks account for 30–40% of total litigation cost and generate no reusable value. No existing platform automates or standardizes this reasoning layer. JuryEdge converts fragmentation into a scalable intelligence market.

Source: Thomson Reuters 2023; Georgetown Law 2023; U.S. Census Bureau 2023.

CITATION: Thomson Reuters Institute 2024; Grand View Research 2024

Automating the Thinking Layer

WHY JURYEDGE WINS: AUTOMATING THE THINKING LAYER. Competitors automate documents, search, or drafting—JuryEdge automates expert-level judgment. Our architecture encodes litigation-specific structures including causation pathways, negligence models, expert reasoning, and trial strategy logic. Vertical depth produces outputs general-purpose tools cannot match. Each case strengthens the system, building a compounding intelligence moat. JuryEdge becomes the platform that scales litigation outcomes—not litigation labor.

Source: ABA 2023; Thomson Reuters 2023; NALP 2023.

Competitors

Automate tasks only

JuryEdge

Automates expert reasoning

Most Cases Settle Because Firms Can't Afford the Firepower to Win

BEFORE

Most firms settle early because they cannot afford the expert analysis, causation modeling, and trial strategy needed to capture full case value. This forces widespread discounted outcomes and gives well-funded defendants asymmetric control. Billions in potential recovery disappear because deep analysis is too slow and too expensive.

AFTER (with JuryEdge)

JuryEdge delivers instant expert-level reasoning, eliminating the cost barrier to thorough case development. Firms negotiate from strength, recover materially higher settlement values, and no longer concede leverage. The platform converts previously unrealized case value into predictable revenue—and levels the playing field.

"Less than 2% of civil cases reach trial" — Bureau of Justice Statistics

Billions Lost in Unrealized Recoveries

Firms forfeit billions yearly because high litigation costs force under-developed claims, weak pleadings, and early discounted settlements. Most cases never reach the analysis level needed to maximize value—leaving enormous recoveries unrealized.

JuryEdge removes these barriers and unlocks value that the current system systematically loses.

Under-Developed Claims

Firms lack resources to fully develop liability theories and causation models, leading to premature settlements.

Weak Pleadings

Boilerplate complaints miss critical legal theories that could dramatically increase case value.

Early Discounted Settlements

Time and cost pressures force firms to accept settlements far below potential trial outcomes.

CITATION: U.S. Chamber Institute for Legal Reform, "Tort Costs in America" (2024); IAALS/U.S. Courts Attorney Survey (2020); U.S. DOJ Civil Justice Statistics

Economic Uplift: Recovering Value the System Leaves Behind

Most firms leave 20-50% of potential case value unrealized because they lack the time, experts, and analytical bandwidth to fully develop claims.

By automating causation analysis, strategic modeling, and expert-level reasoning, JuryEdge enables firms to push settlements closer to true case value—converting discounted resolutions into full-value recoveries. This uplift compounds across every docket, producing significant revenue expansion without increasing headcount.

Capture Full Case Value

Develop comprehensive case strategies that maximize settlement and trial outcomes.

Scale Without Scaling Costs

Handle more cases with the same team by automating time-intensive analytical work.

Build Competitive Advantage

Leverage AI-powered insights that competitors cannot match without similar technology.

CITATION: IAALS/U.S. Courts Attorney Survey (2020); U.S. Chamber ILR (2024)

JuryEdge: A Three-Part, Integrated Revenue Engine

JuryEdge ingests everything—records, depositions, discovery responses, court orders, and exhibits—and continually rewrites your litigation strategy in real time.

SaaS Platform

- AI-powered document analysis and case timeline generation

- Jury intelligence and trial simulation

- Automated trial preparation materials generation

- Expert deposition preparation

1. Case Packs + Services

- Pricing: $500/case

- Baseline target: 200 firms

- High-touch services: $8K–$50K

2. Data / API Platform

- API subscriptions: $499–$9,999/mo

- Annual data products: $8K–$18K/yr

- Enterprise white-label: $100K–$2M/yr

3. Enterprise Case Packs

- $500 per case

- Case packs of 20 for 200 firms (4 firms/state) → ~$2M ramp

- Add-on services and platform upsell layered after initial packs

Traditional Mock Juries Are Too Expensive to Matter

Mock-jury testing costs $10K–$20K for a single day and provides only a one-time snapshot. Because it’s economically impossible to repeat, firms make critical decisions without audience feedback. The result is inconsistent messaging, weak narrative development, and avoidable lost value.

JuryEdge Creates Continuous Jury Intelligence

JuryEdge replaces one-off testing with a venue-specific big-data engine that evaluates every argument, analogy, and theme. Every piece of work product—from complaint to closing—is scored against the same ultimate audience that decides the outcome. This creates real-time narrative optimization never before possible in litigation.

Economic Uplift: Immediate and Compounding

Continuous jury feedback eliminates guesswork and materially improves persuasion at each stage. Instead of spending $10–20K on a single snapshot, firms get unlimited, iterative testing for a fraction of the cost. These improvements push settlements closer to true value and boost trial performance—compounding revenue across an entire docket.

We Are Creating a New Category — The Nielsen of Litigation

No legal platform has ever measured persuasion continuously against a venue-specific jury panel. JuryEdge’s integrated reasoning and audience-testing system creates a data asset competitors cannot replicate. This establishes a new category—audience-validated litigation intelligence—and positions JuryEdge as the central measurement standard for the industry.

Designed Backwards from Verdict

JuryEdge builds every complaint, discovery set, and witness outline with liability proof and trial usability in mind.

- Unmatched Domain Expertise

Randy & Chad bring 1,000+ cases litigated between them, with deep AI & enterprise-scale technical leadership from Diondre.

- Full-Stack Model

Packs → Services → Platform → Data. Complete revenue engine with multiple growth vectors.

- Network Effects

Every case strengthens the AI. High switching costs and ecosystem lock-in create defensible moat.

- Perfect Timing

AI inflection point + post-COVID tech adoption. The window to dominate this category is 18–24 months.

- Built-in Professional Services Revenue

Industry leadership enables high-margin services revenue from the "Randy Methodology" team.

Verdict-First Design

Automated Excellence

Data-Driven Strategy

Built by Trial Lawyers, for Trial Lawyers

Combined 60+ years of trial experience | $2B+ verdicts & settlements | 8,000+ attorney network.

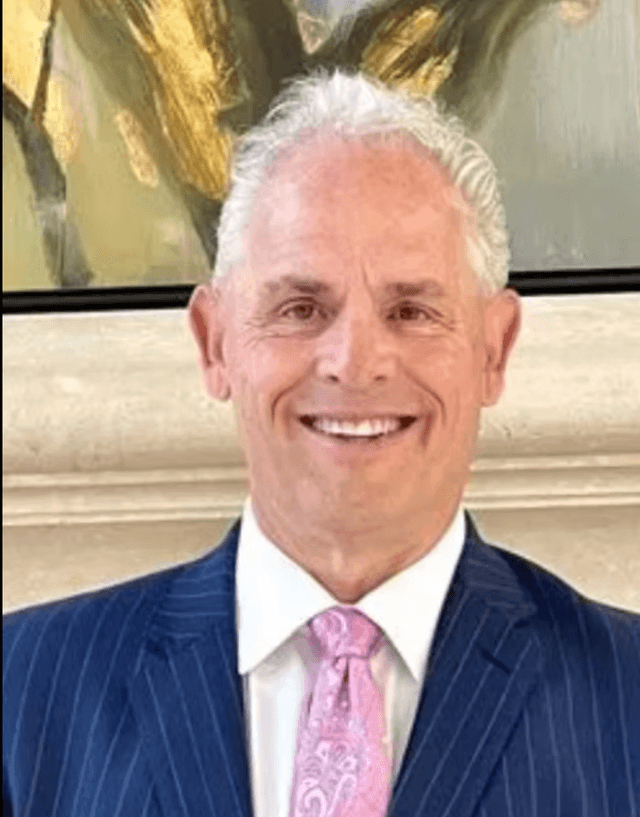

CEO

Randy Hood

Vision Founder - Created the foundational concept for JuryEdge by identifying the structural inefficiencies in litigation and designing the first system capable of automating expert reasoning.

Senior trial attorney with deep expertise in medical malpractice litigation. Decades of courtroom success, known for strategic case preparation and jury presentation excellence. Co-founder of McGowan Hood Felder & Phillips LLC with $2B+ in verdicts and settlements.

CSO

Chad McGowan

CSO - Lead Trial Strategist (Multiple Eight-Figure Verdicts)

Nationally recognized senior trial attorney with deep expertise in case strategy, jury dynamics, and trial communication. Brings industry-leading insight grounded in more than 1,000 combined litigated matters and a combined 65-year institutional track record. Co-founder of McGowan Hood Felder & Phillips LLC, delivering over $2B in verdicts and settlements across high-stakes litigation.

CTO

Diondre Lewis

CTO

CTO with over $2B enterprise software delivered for Fortune 1000 companies. Duke CS Engineer.

Distinguished Engineer/Instructor with 20+ years of enterprise AI and technology leadership. Deep expertise in machine learning, scalable systems, and enterprise solutions. Founder of Wave Technology, leading system design and engineering with deep expertise in scalable legal technology solutions.

Advisory Bench

Lawyers practicing in motor vehicle litigation (auto and commercial vehicle), medical malpractice, products liability, drug/medical device, third party workers comp, brain injury and wrongful death actions

Building Momentum

Founder Investment

Founders have infused $750K of capital into the $2.25M seed round.

The remaining $1.5M allocation represents roughly 11.54% of the company at a $13M pre-money valuation.

Seed Raise Progress

$2.25M raise · December 2025 close$750K committed by founders · $1.5M remaining to complete the round.

Aug 7, 2025

Aug 7, 2025

South Carolina Association for Justice annual meeting on AI and law (200–250 lawyers). Showing core concepts of JuryEdge.

Oct 2025

Oct 2025

Initial development complete.

Dec 2025

Dec 2025

$2.25M seed round underway at a $13M pre-money valuation with a December close target.

Founders have committed $750K in capital; $1.5M remains available (~33.3% ownership).

Jan 2026

Jan 2026

Product beta launch & first paid accounts. System launch in live workshops.

Jan 9, 2026

Jan 9, 2026

University of South Carolina Law and Medical Schools. Educational presentation on AI in legal practice.

Feb 2026

Feb 2026

$100K MRR milestone achieved.

Mar 2026

Mar 2026

$200K MRR milestone achieved.

Apr 2026

Apr 2026

Speaking to hundreds of lawyers at state trial associations. Showing core concepts of JuryEdge.

Jun 2026

Jun 2026

Speaking to hundreds of lawyers at state trial associations. Showing core concepts of JuryEdge.

Jul 2026

Jul 2026

$500K MRR milestone achieved. 3-hour session for 100 trial lawyers in Chicago. Deep dive into the platform's capabilities and real-world applications.

Nov 2025

Nov 2025

Programs for 30 top verdict lawyers in Charleston and Atlanta. Exclusive sessions with elite practitioners.

Q4 2026

Q4 2026

Series A funding round.

The Legal Tech Revolution

The U.S. legal services market was estimated at $396.8 billion in 2024 (Grand View Research, 2024). The litigation segment holds the largest market share at over 29%, equating to approximately $115+ billion in litigation-specific services annually. Tort system costs reached $529 billion in 2022 (U.S. Chamber Institute for Legal Reform, 2024). Attorney billing rates grew 6-7% annually in 2023 (Thomson Reuters 2024), creating urgent demand for efficiency solutions. With 450,000 law firms in the United States (Statista/IBISWorld, 2024), we're targeting a massive market opportunity built on eliminating duplicated analytical work.

Seed Round: $2.25M at $13M Pre-Money Valuation

Delaware C-Corp, completing beta, preparing for launch. Projected to reach $33M ARR by Year 5 with a diversified revenue mix and significant return potential.

Revenue Pillars

Case Packs + Services

Data/API Platform

Law Firm Operating System

Post-SAFE Ownership

Founders

Randy Hood, Chad McGowan, Diondre Lewis

SAFE Investors

$2.25M seed round investors

Use of Funds ($2.25M)

AI training, platform completion, infrastructure. Preparation of Beta Clients and Preparation for Series A.

Sales headcount, conferences, demand gen

Legal, finance, compliance. Preparation of Beta Clients and Preparation for Series A.

Investment Terms

Valuation & Structure:

- •$2.25M investment at $13M pre-money valuation

- •Using SAFE instruments (simple, founder-friendly)

Risk/Downside Protection:

After 3 years, we will offer an option for a 1.5x buyback from professional services revenue.

Return Scenarios (Example: $500K investment)

*Adjusted for 20% Series A dilution (16% ownership post-Series A)

Exit Scenarios

- •Acquisition via private equity

- •Acquisition via large market player

- •Acquisition via larger legal entity

Why JuryEdge Wins

- •Proven expertise: 60+ years combined trial experience, $2B+ in verdicts

- •Conservative projections: $33M ARR by Year 5

- •Massive market: $396.8B+ legal services market (Grand View Research, 2024)

- •Downside protected: 1.5x buyback option

- •Proven founders, 20 years enterprise AI leadership

Financial Projections (Conservative)

Year-over-Year Revenue Growth: Projected journey from $1.119M ARR in Year 1 to $33.2M ARR by Year 5, based on scaling firm adoption and diversified revenue.

Key Assumptions:

- •Base case packs: 200 firms baseline growing to 2,000 firms by Year 4

- •$500/case pricing (20-50 cases per firm annually)

- •Add-on services grow from $0.5M to $10M by Year 4

Strong Financial Fundamentals

Exceptional unit economics with high margins, strong customer lifetime value, and impressive retention rates.

Expert Guidance When You Need It Most

Get custom insights and strategic direction from Chad McGowan and Randy Hood, combined with AI-powered analysis for your most critical cases.

Premium Consulting

Premium consulting with Randy Hood and trial experts for strategic case guidance and insights.

Custom Case Analysis

Custom case analysis for high-stakes litigation, tailored to your specific case, venue, and circumstances.

Jury Consultation

Jury consultation and strategy sessions with expert guidance on case framing, discovery strategy, and trial preparation.

AI-Powered Analysis

Advanced AI tools analyze your case data to provide actionable recommendations and strategic direction.

Professional services are available on a case-by-case basis. Contact us to discuss how we can support your litigation strategy.

Contact UsBe Among the First to Experience JuryEdge

Get early access to the platform and help shape the future of litigation technology.

Frequently Asked Questions

Key questions investors ask about JuryEdge's competitive position, market opportunity, and adoption strategy.